5 Predictions for the Chinese E-commerce in 2025

2025-01-12 16:00:00 | Sweekli

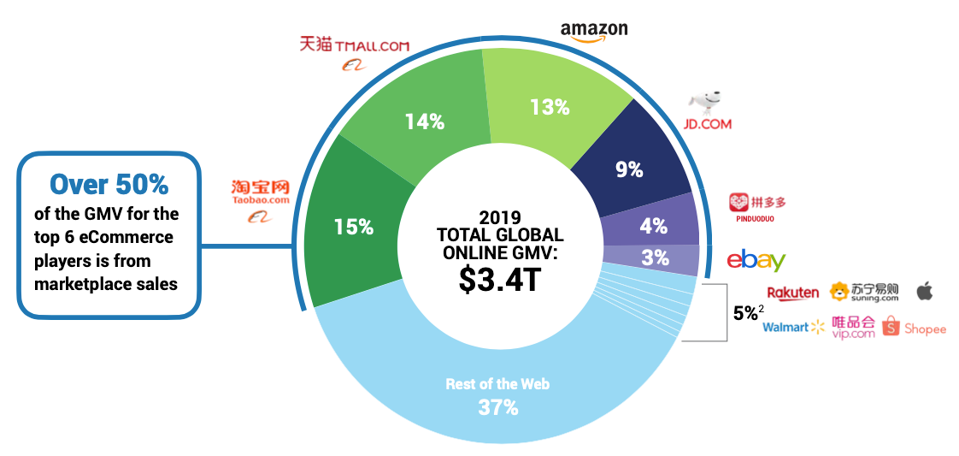

In the year of 2024, China's GDP grew by 4.8% in the first three quarters, specifically, online retail end sales increased by 6.8%, outpacing GDP growth. E-commerce accounted for 26.7% of total retail sales, maintaining China's position as the world's largest e-commerce proportion market - more than double the share in the United States.

Looking ahead to 2025, based on a combination of macro perspectives and micro insights, we present 5 major predictions for the e-commerce. These insights serve as a reference for domestic and international brands, as well as for global businesses seeking to expand into China's market.

1. From Price Wars to Brand Battles: Concentration in Mainstream Industries Will Intensify

Brand competition now determines industry concentration, particularly in mainstream sectors where consolidation is accelerating. Leading brands will expand their categories in white-label-dominated markets, reshaping this sector.

For niche brands, the choice is clear: either scale up to compete in larger markets or solidify their position with robust supply chains and brand strength, creating advantages to compete with major players.

2. Supply Chain: ODM Brands Will Thrive Among Consumers Shift Away from Luxury

As Chinese consumers become less enchanted by luxury / affordable luxury brands, ODM supply chain brands has emerged for global opportunities. Products that can complete the supply chain loop within China will gain a significant edge, especially in today's uncertain international trade environment. Various brands transitioned from OEM, and overseas production to domestic branding. In 2025, this trend will become an industry norm.

Given Chinese consumers' high expectations for rapid product updates, overseas brands must overcome delays caused by international supply chains or fragmented local supply chains. These factors will be critical for long-term success in China.

3. Consumer Trends: Silver Economy Will Drive Significant Growth

In 2025, China's "silver generation" (older consumers) will be a key demographic to watch. For instance, in Japan, the silver generation accounts for 30% of the population but contributes 50% of consumption.

McKinsey's year-end report highlights five consumer groups with rising confidence: urban Gen Z, second-tier city "new middle class," and three older demographics - affluent seniors in metropolises, wealthy middle-aged individuals in towns, and rural middle-aged groups. This indicates massive growth potential in the senior market.

China's silver economy accounts for only 6% of GDP, leaving significant room for growth. With the rapid development of mobile internet and social e-commerce, 2025 will see the silver generation emerge as a mainstream, high-growth demographic.

However, this poses challenges for overseas brands, particularly consumer-facing ones. While China's silver generation holds substantial assets, they often lack brand loyalty toward foreign brands and show limited enthusiasm for new lifestyles. Instead, they prioritize high-quality, well-reputed products. Localizing products and branding effectively will be essential to reaching this demographic.

4. Products: Emotional Value Will Drive Innovation

"Emotional value" is a buzzword in 2025, not just as a concept but as a driver for product innovation. This involves deepening brands’ understanding of their users and strengthening connections with consumers, integrating content marketing with product development seamlessly.

Chinese consumers have particularly high standards for brands and products, especially those with higher premiums compared to local offerings. This stems from China’s strong manufacturing capabilities and the intense competition among brands to offer better sales conditions and elevate brand value.

To succeed, brands must continuously innovate in products and content to cater to consumer preferences, offering emotional value that fosters loyalty and drives commercial success.

5. Channels: A New Cycle for Offline and Traditional E-commerce

In 2024, the number of physical retail stores in China grew steadily, with FMCG stores up 1%, small supermarkets up 4.6%, and convenience stores up 3.5%. Why is offline retail regaining traction? Costs for rent and labor are at historic lows, marking a new era where businesses must embrace offline opportunities.

Similarly, traditional e-commerce is seeing a resurgence. This year, many merchants adopted a dual strategy: focusing on profitability on Tmall and Taobao while driving volume on Douyin. However, merchants are now scaling back on Douyin e-commerce to focus on breaking even.

As merchants shift from price wars to branding, platforms like Taobao, Tmall, and JD.com are gaining new opportunities, particularly with high-net-worth users. These shelf e-commerce platforms and offline channels offer fresh growth potential. Leveraging these platforms to build brands, engage members, and articulate value propositions is the key challenge and opportunity of this new cycle.

To seize the opportunities in China's e-commerce market in 2025, contact China's leading distributor of international brands, Sweekli, at purchase@sweekli.com.